Key highlights

- Official policy framing is clear: global MMF consumption dominates, while India has historically leaned toward cotton. Ministry of Textiles

- India is pushing scale in MMF via textiles policy tools, including a PLI scheme aimed at MMF/technical textiles. Ministry of Textiles

- The demand story is becoming a two-lane highway: cotton = comfort + heritage + “natural” narrative, MMF = performance + scale + price efficiency.

Why buyers keep shifting toward MMF

MMF wins when buyers want:

- consistency in quality and large lots

- performance features (stretch, durability, quick-dry, blends)

- cost control across seasons

The Ministry of Textiles explicitly notes the global dominance of MMF consumption and India’s need to increase MMF focus alongside cotton. Ministry of Textiles

The policy signal that matters in 2026

The Ministry of Textiles details:

- India’s MMF textiles & apparel exports (example: USD 8.19 bn in FY 2023–24)

- the strategic push to grow global MMF share

- PLI outlay and performance window for scaling MMF/technical textiles Ministry of Textiles

This is not cosmetic policy—it’s a “rebuild the product mix” policy.

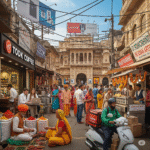

Where cotton still wins

Cotton remains the emotional and climatic default for many Indian consumers, and it anchors huge livelihoods. Cotton also rides the sustainability narrative (when traceability is credible). The future isn’t cotton vs MMF; it’s cotton plusMMF blends in more categories.

Small questions people search

“Will cotton demand crash?”

Not necessarily. But growth momentum often shows up faster in MMF segments where price + performance drive scale. Ministry of Textiles

“What should MSME units do?”

Survive by specialising: either premium cotton craft value or MMF performance segments—don’t stay stuck in undifferentiated basics.