NEW DELHI, February 2026 — As India dominates global headlines as the “fastest-growing major economy,” a deeper look into the ground reality reveals a complex paradox. While the GDP numbers suggest a soaring trajectory, structural imbalances are raising a fundamental question: is India merely growing, or is it truly developing?

As the nation marches toward its 2047 “Viksit Bharat” goal, experts suggest that the current model—fueled by high-end consumption and a booming financial sector—may need a radical reset to ensure long-term stability.

The “K-Shaped” Consumption Trap

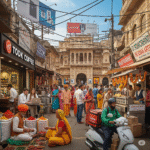

India’s growth is currently anchored by private consumption, which contributes roughly 60% to the GDP. However, this is not a uniform rise. The economy is witnessing a K-shaped recovery, where the top 10% of the population drives a surge in luxury goods, high-end real estate, and the “attention economy.”

Meanwhile, the bottom 50% of the population has seen its share of national income shrink. This disparity is visible in the market: while premium smartphone sales are breaking records, the demand for entry-level consumer goods in rural India remains sluggish.

Manufacturing: The Missing Middle

A “Developed India” requires a powerhouse manufacturing sector, yet the reality remains stagnant. For over a decade, manufacturing’s share of the GDP has hovered between 17% and 18%, failing to hit the 25% target envisioned by the “Make in India” initiative.

The core issue is low-value addition. While India has emerged as a global hub for smartphone assembly, high-value components—like semiconductors, displays, and memory chips—are still largely imported. This keeps the country dependent on global supply chains and limits the creation of high-paying industrial jobs.

The Financialization of the Economy

One of the most startling trends highlighted in recent analyses is the “financialization” of the Indian economy. The Banking, Financial Services, and Insurance (BFSI) sector has grown 50 times over in 20 years, now accounting for 27% of the GDP.

While increased participation in the stock market and SIPs (which have grown six-fold since 2016) is a sign of rising household wealth, there is a catch. Economists warn that “money making money” in the financial markets does not always translate to “real economy” growth. For sustainable development, this capital must be redirected into productive assets like factories and infrastructure rather than staying trapped in speculative cycles.

Demographic Dividend or Liability?

India is currently in a unique “demographic window” where 65% of its population will be of working age by 2031. However, this dividend is a double-edged sword.

- The Asset: If this workforce is skilled and absorbed into high-value manufacturing and services.

- The Liability: If jobless growth continues, leading to a surplus of “self-employed” workers in low-productivity, informal roles.

Current data shows that while casual wages have seen a slight uptick, real regular wages (adjusted for inflation) have faced contraction, reflecting the ongoing struggle of the formal job market.

The Road to 2047: Four Pillars of Change

To bridge the gap between growth and development, the transition must focus on:

- Product Complexification: Moving from basic assembly to manufacturing complex, high-value goods for the global market.

- Private Investment: Encouraging India’s top 20 firms—who currently hold 64% of all corporate profits—to reinvest in long-term productive capacity.

- Regulatory Ease: Improving the “FDI Confidence Index” (which slipped to 24th in 2025) by addressing land acquisition and taxation hurdles.

- Inclusive Human Capital: Moving beyond “welfare” to “empowerment” through high-quality education and healthcare for the rural 45% still dependent on agriculture.

Bottom Line

Economic growth is a number; development is a lived experience. If India is to become a truly “Viksit Bharat,” the focus must shift from how much the economy is producing to what it is producing and who is benefiting. The next decade will determine if India becomes a global production powerhouse or remains merely a massive consumption market for foreign goods.